09 August 2023

Bangchak Group Reports Half Year Results, with Total Revenue of 148,403 million Baht. Holding the Fort Amidst Global Oil Market Volatility

Bangchak Group announced its performance for the first half of 2023, recording a total revenue of THB 148,403 million and EBITDA of THB 17,620 million. Falling energy prices from concerns over the global economic slowdown pressured the Refinery and Oil Trading Business Group. However, other investments and expansions in various potential businesses, such as OKEA’s acquisition of stakes in Wintershall Dea in Norway, investments in two additional projects of natural gas power plants in the United States, have supported business expansion and revenue generation, resulting in net profit attributable to owners of the parent of THB 3,199 million, representing the earning per share of THB 2.16.

Chaiwat Kovavisarach, Group Chief Executive Officer and President, Bangchak Corporation Public Company Limited revealed that in the first half of the year 2023, despite facing challenges and experiencing impacts from fluctuating energy prices, with the average price of crude oil at USD 78.92 per barrel in the first half of 2023, down from USD 102.17 per barrel in the first half of 2022, and an Inventory Loss of THB 2,952 million, Bangchak Group managed to sustain operational performance and generate continuous revenue. The Group, along with its affiliates, achieved a revenue of THB 148,403 million from sales and services, resulting in an EBITDA of THB 17,620 million.

First-Half 2023 Performances by Business Group are as follows.

Refinery and Oil Trading Business Group recorded an EBITDA of THB 5,402 million, Operating GRM decreased from USD 15.87 to USD 8.10 per barrel, owing to a broad-based decline in the crack spreads across products alongside the global economic backdrop. During the first half of 2023, the recognition of Inventory Loss totalled USD 3.23 per barrel, equivalent to THB 2,443 million, following falling crude oil prices. Nevertheless, Bangchak Refinery maintained high production levels, at 121,700 barrels per day or a 101% utilization rate.

Marketing Business Group recorded an EBITDA of THB 1,290 million. Net Marketing Margin edged up following the retail price adjustment to better reflect actual costs. Refined products’ sales volume exceeded pre-COVID levels, reaching 3,191 million litres, representing an 11% increase year-on-year, driven by the rebounded of aviation fuel, alongside the recovery of the global tourism sector and marketing campaigns aimed at boosting service station sales.

Power Plant Business Group recorded an EBITDA of THB 1,841 million. This is attributed to the expiration of the adder scheme for solar projects in Thailand, and the temporary half of hydropower projects in Lao PDR in preparation to transmit electricity production to Vietnam Electricity (EVN). Nonetheless, BCPG has made strategic investments in four combined cycle gas turbine power plants in the United States, which increased its combined capacity from 390.7 MW to 968.7 MW.

Bio-Based Products Business Group recorded an EBITDA of THB 245 million. The biodiesel business experienced a decline in gross profit due to decreased selling prices of biodiesel, crude glycerin, and refined glycerin. The ethanol business recorded increased revenue and gross profit driven by an increase in average selling price, which aligns with the corresponding rise in raw material costs. The High Value Products (HVP) business recorded a rise in gross profits, primarily driven by the launch of new health and well-being products under the brand “B nature+”.

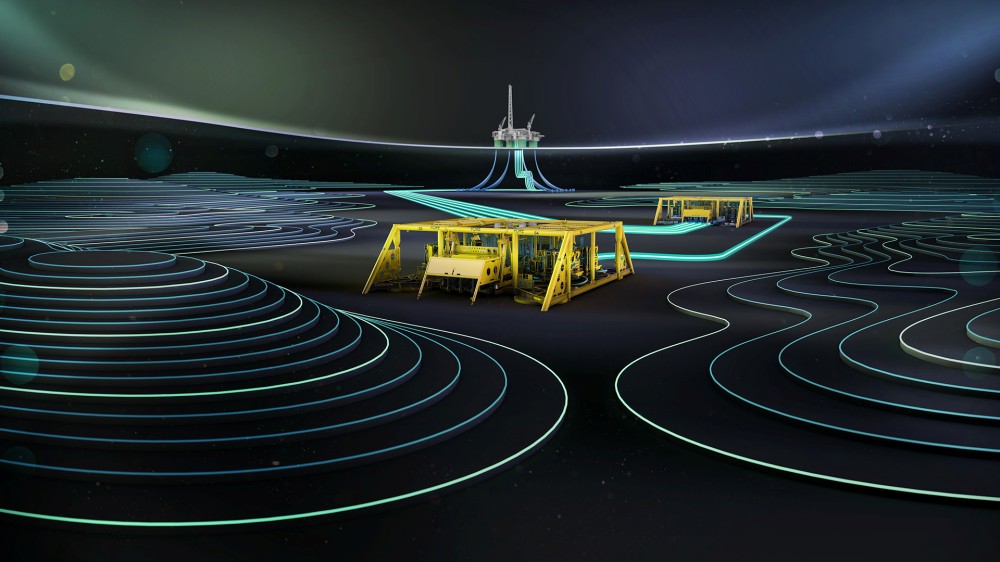

The Natural Resource Business Group recorded an EBITDA of THB 9,115 million. OKEA’s sales volume remarkably improved by 93% year on year. This increase in sales volume of oil and natural gas was due to higher sales volume than production capacity as stipulated in contracts during the first quarter of 2023. Additionally, the first half of 2023 saw the realization of operational results from the transferred business operations from Wintershall Dea, which began in the fourth quarter of 2022.

For the second quarter of 2023, the company and its subsidiaries achieved a revenue of THB 68,023 million from sales and services. The EBITDA stood at THB 6,628 million, with a net profit for the parent company of THB 458 million, translating to an earnings per share of THB 0.24. During this quarter, the oil-related businesses faced pressure due to declining crude oil prices and reduced demand for products stemming from global pressures and excess supply, resulting in an inventory loss of THB 1,036 million. Meanwhile, the Natural Resources Business maintained production levels similar to the first quarter of 2023 but experienced a decrease in sales compared to the same period. The significant difference between sales volume and production capacity was due to contractual obligations. The Power Business, saw increased solar energy sales in Japan due to seasonal factors, while the hydroelectric power plant in Laos initiated commercial electricity production and distribution to Vietnam in June 2023.

Bangchak has launched a program “Fry to Fly” to purchase used cooking oil from households at various gas stations and collection points to produce Sustainable Aviation Fuel (SAF) from used cooking oil, Thailand’s first and only company, with a production capacity of one million litres per day. The development is a clear manifestation of Bangchak’s implementation of the BCP 316 NET plan, aiming for Carbon Neutrality by 2030, and achieving Net Zero GHG Emissions by 2050.

Chaiwat added that for the second half of 2023, oil price increase is anticipated due to the stabilizing market conditions and the recovery of oil demand from China. Moreover, it is projected that the refining margin for cracking refineries in Q3/2023 will show an upward trend against Q2/2023, supported by the rising trend of crude oil prices. In light of these factors, the company remains vigilant, closely monitors, evaluates the oil price situation, and operates its business prudently. This approach is complemented by efficient management and enhanced operational processes to ensure adaptability and efficiency in production and overall operations."

In accordance with Bangchak’s announcement of shares acquisition in Esso (Thailand) Company Limited from ExxonMobil Asia Holdings Pte. Ltd., the company has currently received conditional approval from the Trade Competition Commission's office to proceed with the integration of businesses. The process is ongoing and under consideration of the specified conditions, with the aim to conclude the integration within the year 2023. Upon the completion of the transaction, this move will not only fortify the oil business of the Bangchak Group but will also yield positive impacts for the nation. This includes bolstering energy stability, enhancing energy access, and extending benefits to both business partners and consumers.